Social security taken out of paycheck

The Social Security Retirement Benefits program SS is a pay as you go insurance plan intended to supplement any other retirement plan you have. The amount withheld for federal taxes depends on the information youve filled out on your Form W-4.

Understanding Your W 2 Controller S Office

More plainly this is the tax that funds the Social Security program.

. It should not be relied upon to calculate exact taxes payroll or other financial data. The amount withheld from your paycheck for FICA goes to Social Security and while most of that money is for retirement 15. Currently many retirees pay taxes on their Social Security benefits.

Refer to Whats New in Publication 15 for the current wage limit for social security wages. Dont have a computer. The Open Social Security Calculator A Review.

The Social Security tax is a regressive tax which means that a bigger share of the total income. Instead beneficiaries can choose to have income tax withheld at one of four flat rates 7 percent 10 percent 12 percent or 22 percent. If youre trying to figure out when to claim social security I highly recommend spending 15 minutes with The Open Social Security CalculatorIt takes all of the complexity out of the topic and tells you in very simple terms when both you and your spouse should file for social security to.

The wage base limit is the maximum wage thats subject to the tax for that year. While Natalie and Juans retirement paycheck of 70000 remains the same they pay approximately 37 less in taxes and withdraw smaller amounts from. Social security should be taken out of the hands of the government.

I did not understand the FICA and asked. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. Workers pay into the program through payroll taxes taken out of their paychecks.

Important note on the salary paycheck calculator. Even if a household earns enough to avoid paying federal income tax the Social Security tax may still be deducted from their wages. You can now view your pay stubs online anytime anywhere.

FICA taxes go toward Social Security and Medicare. In other words even though 62 of your paycheck gets. You can also access ViewMyPaycheck from your mobile device.

In its most basic form OASDI is Social Security taxes. Unlike wages and pensions withholding on Social Security benefits and other government payments is voluntary and not based on withholding allowances. Family or financial obligations might require that you bring home a bigger paycheck each.

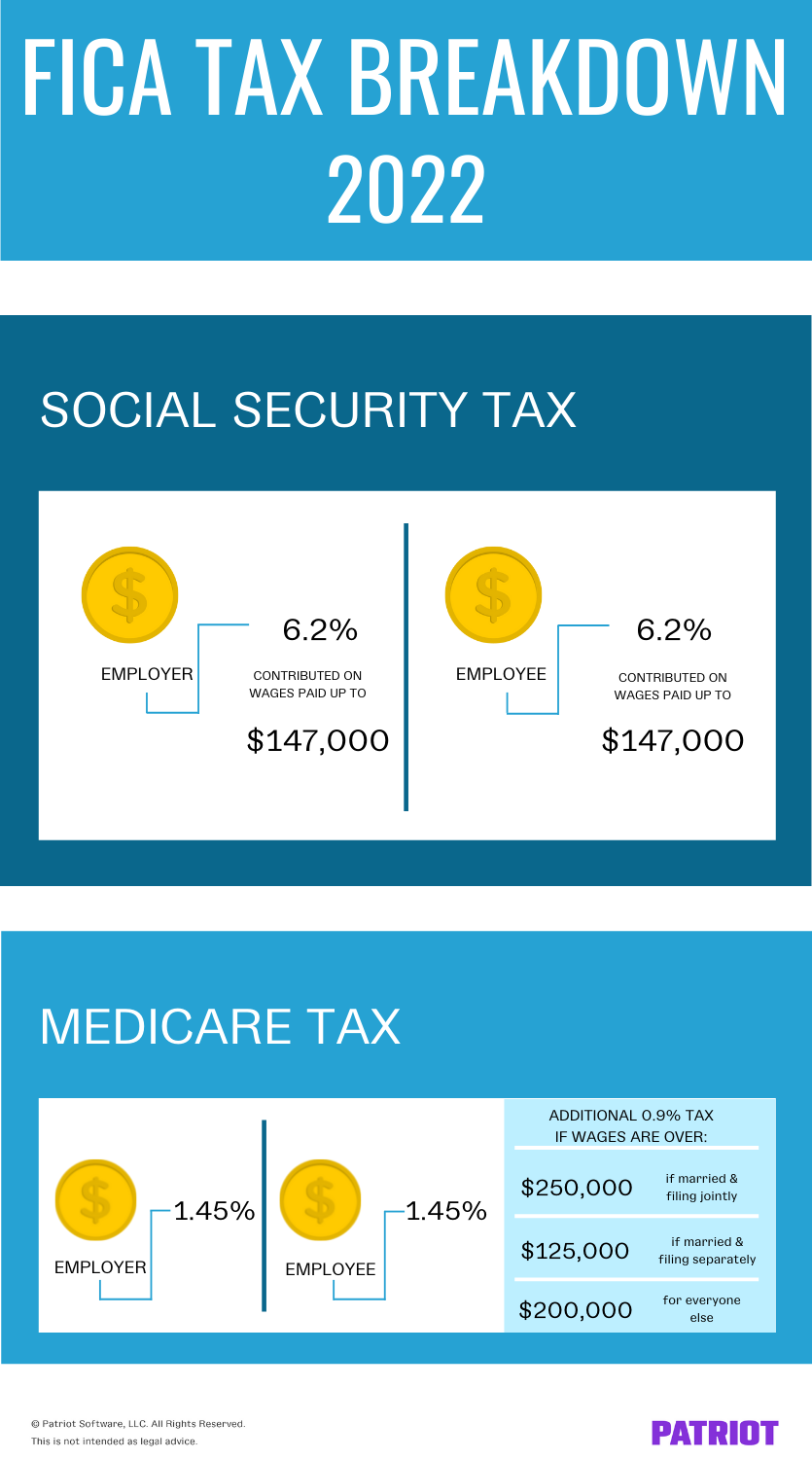

A new bill though would get rid of those taxes and make up for the revenue by raising the cap on payroll tax payments from. As you work throughout your lifetime Social Security taxes are taken out of your paycheck. Medicare taxes unlike Social Security tax go to pay for expenditures for current Medicare beneficiaries.

Your employer most likely takes federal income tax Social Security tax Medicare tax and state income tax out of your paychecks. This tax is automatically taken out of your paycheck and your employer must pay a matching amount as well. Currently many retirees pay taxes on their Social Security benefits.

See our Social Security Payment Schedule for August 2021 for the dates when checks will be deposited this month including SSDI and SSI. The Social Security Trustees annual report estimates that taxes on Social Security will total 451 billion in 2022 up from 345 billion in 2021. This is true even if you have nothing withheld for federal state and local income taxes.

The Social Security Expansion Act sponsored by Sanders and Senator Elizabeth Warren D-MA would lift the income tax cap and apply the Social Security payroll tax to all income above 250000. Depending on your location you might pay local income tax and state unemployment tax as well. Social Security Taxes as an Example.

A new bill though would get rid of those taxes and make up for the revenue by raising the cap on payroll tax payments from 147000 to 250000. Or Publication 51 for agricultural employers. Your employer withholds 145 of your gross.

Only the social security tax has a wage base limit. 2 is taken out of your pay every month if you earn over 250 in a calendar month. In Denver youll pay 575 monthly if you make more than 500 in a calendar month.

A single taxpayer earning 10000 in gross income in a given year for example. The tax funds the payments of retiree benefits survivor benefits and Social Security disability benefits. Once you reach the maximum taxable earnings currently 142800 for calendar year 2021 withholdings from your employer will discontinue resulting in a higher paycheck says Mike Biggica a certified.

Something like a Fed for poor people or people who are almost certain to become poor without it. These calculators are not intended to provide tax or legal advice and do not represent any ADP. Currently workers have 124 percent taken out of each paycheck and contributed to the Trust Fund half paid.

A key fact to remember Social Security is similar to many 401k plans in that your employer matches your contributions dollar-for-dollar. Skip advert There are ways you can lower. A financial advisor can help you figure out how Social Security will factor into your retirement plans.

Require millionaires and billionaires to pay their fair share into Social Security. Usually you must have Medicare and Social Security withholdings on each paycheck. When Do You Stop Paying Into Social Security.

Earnings over 142800 are not taxed by Social Security or used to calculate future Social Security payments. In 1968 I received my first real paycheck along with an explanation of the state and federal taxes withheld and FICA withholding. For earnings in 2022 this base is 147000.

This has a big payoff for them because by delaying claiming Social Security until age 70 the percentage of their Social Security income that gets taxed is cut from 85 to 4833.

What Is Social Security Tax Calculations Reporting More

Paycheck Taxes Federal State Local Withholding H R Block

Is There A Way To Print A Social Security Number On The Pay Stub

What Happens When Employer Doesn T Withhold Social Security From Your Pay Sapling

Pin On Places To Visit

Pin On Social Security Disability Law

What To Do When Excess Social Security Tax Is Withheld Stanfield O Dell Tulsa Cpa Firm

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

How To Read Your Paycheck Stub Clearpoint Credit Counseling Cccs Credit Counseling Independent Contractor Debt Relief

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

What Exactly Gets Taken Out Of Your Paycheck Tax Deductions Paycheck Payroll

What Is Social Security Tax Calculations Reporting More

30 Financial Literacy Lesson Plans For Every Grade Level Financial Literacy Lessons Financial Literacy Consumer Math

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated